Intuit recently came up with the announcement “Intuit Retires Online Payroll ” and wants all users to shift to QuickBooks Online Payroll. Intuit quoted that it wants to put all its focus on payroll services & products. Further, the QuickBooks platform provides more modern and better payroll plans coupled with more advanced features and development support.

Intuit Online Payroll users will close out this calendar year before making the changes. By this time, Intuit will aid with the move for making the change as smooth as possible. QuickBooks Online Payroll includes Intuit Online Payroll employee data, tax info. & past payroll info once accountants and their clients sign into it.

Reasons For Transition

Intuit is giving up Intuit Online Payroll Enhanced and Intuit Online Payroll Full Service and wants its users to adapt to the transition to QuickBooks Online Payroll. Firstly, this will help QuickBooks to widen its focus on delivering the best online payroll services & products. Moreover, it will have modern features, better automation & development support.

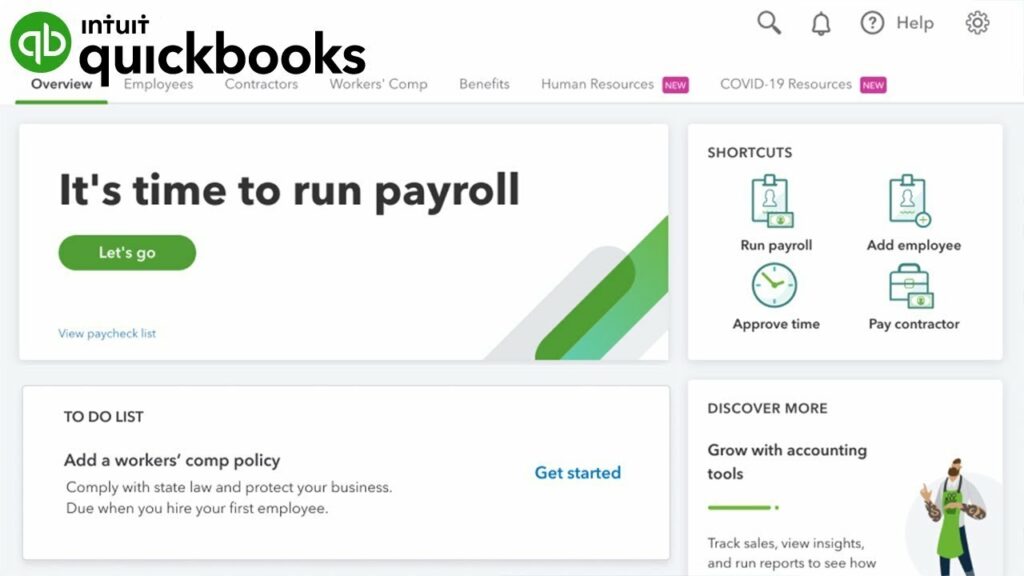

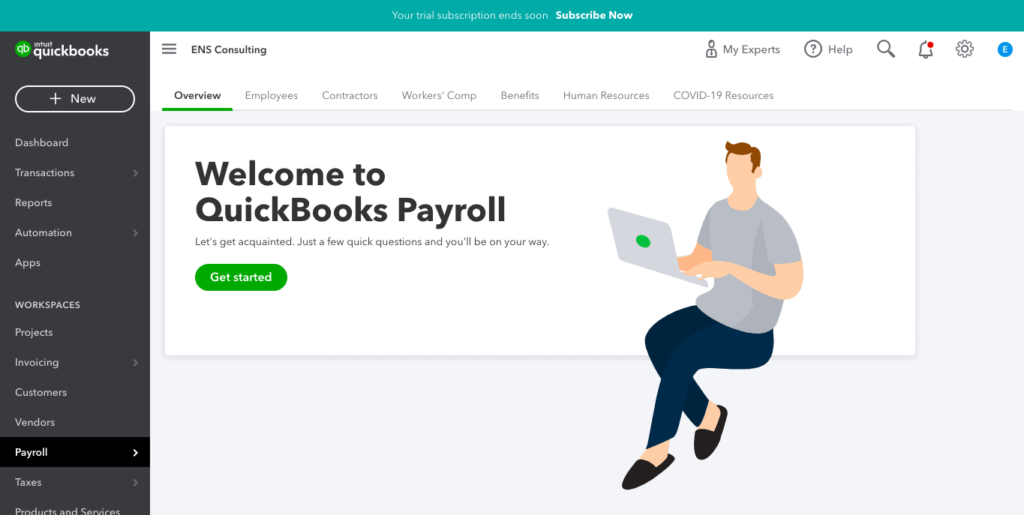

QuickBooks Online Payroll: Overview

All clients will link to QuickBooks Online Accountant along with QuickBooks Online Payroll Elite free of cost. In case you are using paid services of QuickBooks Online Payroll, then you can also use Elite at no extra cost. Thus, all the clients will be moved to a standalone QuickBooks Online Payroll product.

- Users on Intuit Online Payroll Enhanced will be moved to Standalone QuickBooks Online Payroll Core.

- Users on Intuit Online Payroll Full Service will be moved to Standalone QuickBooks Online Payroll Premium

All in all, once users adopt the transition, they can easily move to any product in the QuickBooks Online Payroll product: Premium, Core, or Elite.

QuickBooks Online Payroll: Benefits

QuickBooks Online Payroll is a better version of payroll service having modern features, better automation & development support.

Users moving to Standalone QuickBooks Online Payroll Core will get these benefits:

- Full Payroll Service along with automated taxes and forms.

- Auto Payroll Service for salaried employees based on direct deposit.

- Integrated Health benefits for the team, sponsored by Simply Insured

Users moving to Standalone QuickBooks Online Premium will see these benefits:

- Advanced time tracking system with easy, multi-device accessibility & location tracking system.

- Professional setup review to ensure the setup is correctly done.

- Auto Payroll services for salaried employees based on direct deposit

- HR assistance center sponsored by Mammoth

How To Do This Transition?

Intuit will notify all its users in advance that the Intuit Online Payroll accounts are all set for transition to QuickBooks Online Payroll. During this period, Intuit will communicate with everyone via email and in-product messaging. Moreover, Intuit will guide every client through the transition process in the product and give a clear view of progress in their process.

Do You Need To Re-Enter Any Payroll Data Into QuickBooks Online Payroll?

It is a Big No. The transition from Intuit Online Payroll to QuickBooks Online Payroll is quick, smooth, and fully automated. Once you log in to QuickBooks Online Payroll, Intuit Online Payroll, Intuit Full Service Payroll employee data, tax info. & past payroll will come up. Just a reminder, you need to move to a Standalone QuickBooks Online Payroll product. For most users, the transition will be smooth and completed within a minute. No issues will come up in the transition else the Support team will surely assist you in no time.

Also find, G7 Tax Plans: Targeting World’s Richest After 40% Wealth Growth

Differences In Pricing Structure

Intuit offers QuickBooks Online Payroll discounted pricing for all the ProAdvisors. Intuit is finalizing the pricing details. It will put up the discounted pricing structure in the coming time. All the pricing chances will come up in a few days. Any significant price increase will be depending on the cost you pay today on the Intuit Online Payroll products & services. Some of the customers can see a price rise and some can see a price decrease. Once the transition date comes, Intuit will come in touch with you via e-mails.

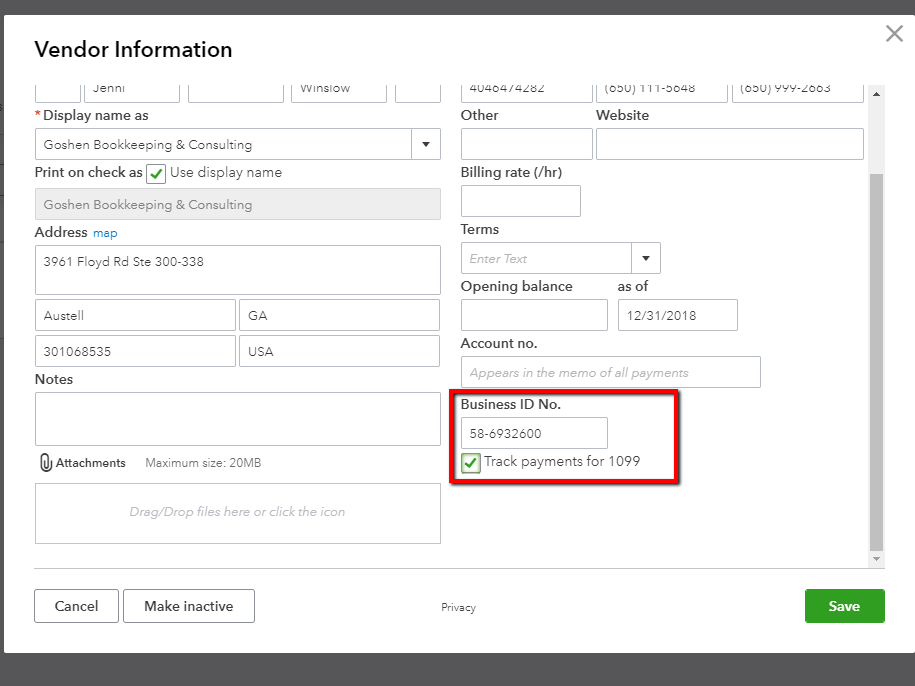

Preparing 1099s For Clients

Yes, you can easily prepare 1099s for the clients with the latest transition. But if the client is an active user of QuickBooks Online or QuickBooks Online Payroll, one can easily prepare the 1099 forms directly in their account. The cost of these 1099s forms comes with your subscription once you are down with the transition process.

Final Say!

This article deals with one major topic: Intuit retires Intuit Online Payroll Services. From its transition to its benefits, we have tried to put together a bunch of valuable info. in a nutshell. All in all, it is not a bad deal to retire with the existing services and opt for better-advanced services. We hope you got each and every piece of information that you have been looking for.

For further QuickBooks-related queries, you can always join us. We are available for you 24×7 via email, chat support, and calling services.

Average Rating