The world’s richest 500 people are currently worth $8.4 trillion, up over 40% in the 18 months since the worldwide pandemic started its devastation. In the interim, the economy’s greatest champions, the tech enterprises that made a significant number of these tremendous fortunes, pay lower tax rates than a clerk. And their uber-rich founders can use legal loopholes to pass huge benefits onto heirs significantly tax-free.

Recently, a group elite enough to challenge the matchless quality of the tech titans is nearly making a move. The heads of the Group of Seven, including U.S. President Joe Biden and U.K. Leader Boris Johnson, met in southwestern England this weekend. There they will take steps to underwrite an agreement to find loopholes in the world’s flawed tax framework.

While these progressions actually need approval from some bigger countries, including China. Prior to turning out to be a reality, the agreement by the G-7 is a memorable defining moment after decades of failure in the tax system loopholes used by multinational corporations.

Philippe Martin, a former adviser to French President Emmanuel Macron, Head of the Conseil D’Analyse Economique saïd. “It is extremely easy for multinationals and the wealthiest people to get away from taxes. What we are seeing with the G-7 is that the opportunity has come for the government to reclaim power. There is an open door, a turning point at which they are acknowledging they need tax power and they have to spend more.”

Biden’s Plans: G7 Tax Deal

This G-7 deal will support Biden’s own plans to pump up taxes on multinational corporations and the rich by raising tax rates, making the company heirs pay more, and leveling rates between workers & investors.

The G-7 amendments are important for a global revival of initiatives. It puts focus on the rich, from Washington to Buenos Aires to Stockholm. It includes new tax duties on inheritances, capital gains, and wealth that have acquired momentum since Covid-19 blew massive financial holes in government plans and budgets across the world.

U.S. Treasury Secretary Janet Yellen framed the G7 tax plan. It will form a route for governments to protect their national sovereignty and set better tax policies.

Janet Yellen said, “For a really long time, there has been a global race in the corporate tax system.”

Yellen was joined by the finance ministers of Indonesia, Germany, South Africa & Mexico in a Washington Post opinion piece Thursday, calling out all the nations in the international tax talks “to meet up in a political agreement in accordance with the prescribed timeline and before the G-20 finance ministers meeting the following month.”

G7 Tax Agreement: Amazon & Other Tech Giants

Amazon and some other tech organizations, meanwhile, have embraced this G7 tax agreement. They believe the global system will be more reasonable than expensive alternatives sought by individual nations. Bezos has likewise voiced support for more U.S. corporate taxes for infrastructure pay.

Advocates for higher taxes say these steps are important to fight off an ascent in populism. It will also moreover help to sustain capitalism. Gabriel Zucman, the University of California at Berkeley economics professor said. “The most prominent and visible winners of globalization are these large multinationals whose effective tax rates have imploded. That can only give rise to a growing exclusion of globalization by the people.”

Progressive Taxation: Overview

The World Economic Forum, the annual conference organizer for the rich and powerful in Davos, Switzerland, gave a paper this month contending “tax systems should be redesigned efficiently to multinationals & tax capitals.”

Governments need the income & revenue and “progressive taxation will be a fundamental instrument to make up for the lopsided recovery effectively underway.”

There are still a lot of low-tax defendants.

Conservative economists namely Douglas Holtz-Eakin, President of the American Action Forum, contend taxing the corporations & wealthy more heavily will harm the economy.

Holtz-Eakin, Adviser to President George W. Bush said, “Higher taxes on capital generally gives rise to the chances of a slowdown in productivity growth.”

That view is losing ground however as resentment rises over the manners that highly profitable and productive corporations reduce their taxes.

Amazon, Netflix, Facebook, Apple, Microsoft & Google collectively evaded approximately $100 billion in U.S. taxes in the last decade, as per an analysis of regulatory filings from Fair Tax Mark, a reformist research organization. Large numbers of those untaxed profits were moved into tax havens like Luxembourg, Netherlands, Ireland & Bermuda.

Tax Rates: Amazon, FaceBook & Many More

As per the Bloomberg Economics analysis, amazon paid a corporate tax rate of around 11.8% in the year 2020. It is nothing but an anomaly among highly successful tech organizations. Facebook, founded by the world’s 5th richest person, Mark Zuckerberg, paid around 12.2% in the year 2019.

As a blend between a tech company and a retailer with monstrous physical infrastructure, Amazon can utilize a high number of long-standing, low-profile tax preferences for compensation in taxes, buildings, research, development, etc. Jeff Bezos now pushes to reinvest profits into the organization, a business strategy that keeps taxable pay low and tax cuts high.

Amazon totally stayed away from government income taxes in 2018 and 2019. All thanks to its brilliant use of the tax code. Since then, Amazon has had to pay some income tax to the IRS. But it’s been far underneath the 21% headline rate introduced under President Donald Trump.

Tycoon tech founders often pay quite less personally than their organizations do.

Bezos, for instance, got $77 billion richer in the year 2020, as per the Bloomberg Billionaires Index. Yet in the U.S., gains on stock can only be taxed once they’re sold. And there are also at a much lower rate than what the well-off workers pay. It means that Bezos owed a few billion dollars in taxes to the U.S. Treasury last year.

The Rich Paying Tax: True Or Not!

Ron Wyden, Chairman of Senate Finance Committee said, “This country’s richest, who benefited greatly during the Covid-19 pandemic, have not been paying their fair tax share,” pointing fingers at billionaires like Jeff Bezos & many others.

The media associations said it acquired confidential tax reports on a large number of the richest Americans, including Michael Bloomberg & Warren Buffett. Bloomberg and others quoted to ProPublica saying they had fully paid the federal taxes they owed.

To eliminate advantages in the U.S. tax code that benefit the super-rich, Biden has brought taxing inherited assets that boost the top rate on investment income and presently escape levies, so that the investors & well-paid workers pay the same.

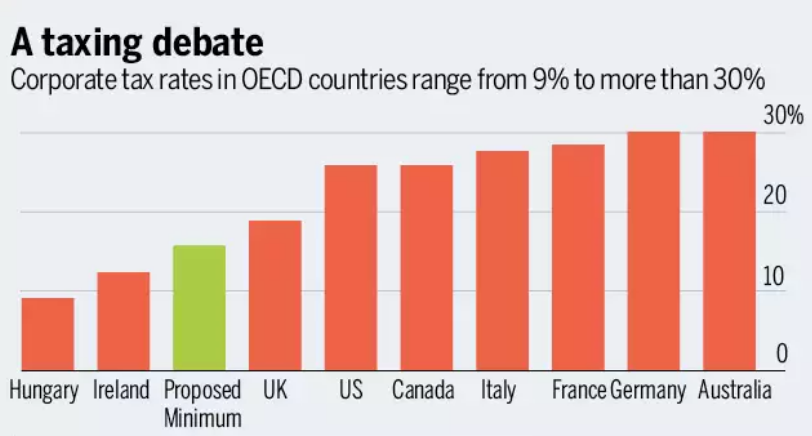

On a worldwide scale, the administration is looking for a global minimum tax of at least 15%. It will put the rising effect of taxes on the world’s most profitable organizations. The deal expected to move forward at the G-7 meeting.

You can also read, why did Intuit Retires Intuit Online Payroll?

The 28% Tax Overhaul

The G-7 deal would change other guidelines for taxing multinationals. It aims to undercut efforts and move profits to low-tax nations. Biden is also proposing to increase the U.S. corporate rate to at least 28%, partly countering Trump’s tax overhaul.

As per Morgan Stanley, Tech giants could witness their effective tax rates rise after the success of such a global tax deal. Alphabet’s Google & Facebook would have to both pay 28% on their worldwide profits, up from 17% and 18% respectively within the present rules.

For all the hustle of Biden’s proposals, taxing the rich, and the international tax deal, face genuine hurdles before they can be legally adopted.

While some of his fellow Democrats, who control Congress, are pushing forward for more extreme changes to the taxes of wealth & estates whereas the others are quite reluctant.

The next stage for the global tax deal negotiations includes around 140 countries. It was launched years ago by the Organization for Economic Cooperation and Development. And they plan to win an agreement among the Group of 20 nations. G-20 oversees around 90% of the world’s economy. G-20 finance ministers will have a meeting in August in Venice.

China is the main stumbling block for reaching a successful deal by the year-end & they demand exemptions from the minimum tax.

All in all, there are high hopes the global effort “puts a full stop to the craziness”. Pascal Saint-Amans, Director of the Center for Tax Policy at the OECD said. “You had legal loopholes all over the place and nobody was dealing with that. It’s subverting the very goal of a free-market economy & capitalism.”

Winding-Up The G7 Tax Plans!

This article is no less than an informative project on the G7 Tax plans. It targets the wealthy tech giants after a sudden 40% net worth rise in this Covid-19 pandemic. It is becoming a matter of concern and tax loopholes must be cleared out. We hope you admire our efforts to bring each and every piece of significant information on G7 tax plans. For any more assistance, you can always join us. We will always be present for you 24×7.

Average Rating